Cathay Life is committed to our service philosophy of being customer-centered by providing diverse heart-warming services and listening to the customers. We provide more user-friendly service, so that customers can feel our warm care during every service journey.

Treating Customers Fairly

In order to protect customer rights and interests, Cathay Life has built a corporate culture that centers on the spirit of “treating customers fairly.” In 2018, Cathay Life became the first in the industry to establish the Treating Customers Fairly Committee. Through active participation and promotion, the Board of Directors has helped internalize the spirit of fair customer treatment in Cathay Life employees from top to bottom. �2020, Cathay Life increased the frequency of reviewing its implementation of fair customer treatment principles, and added customer satisfaction to the list of key performance indicators of fair customer treatment. In doing so, we examined our relevant practices more comprehensively and demonstrated our determination to realize fair customer treatment and protect customer rights.

Cathay Life has been rated excellent (ranked top 20% among insurance companies) in the fair customer treatment assessment conducted by the FSC for three consecutive years.

Customer Satisfaction Survey�

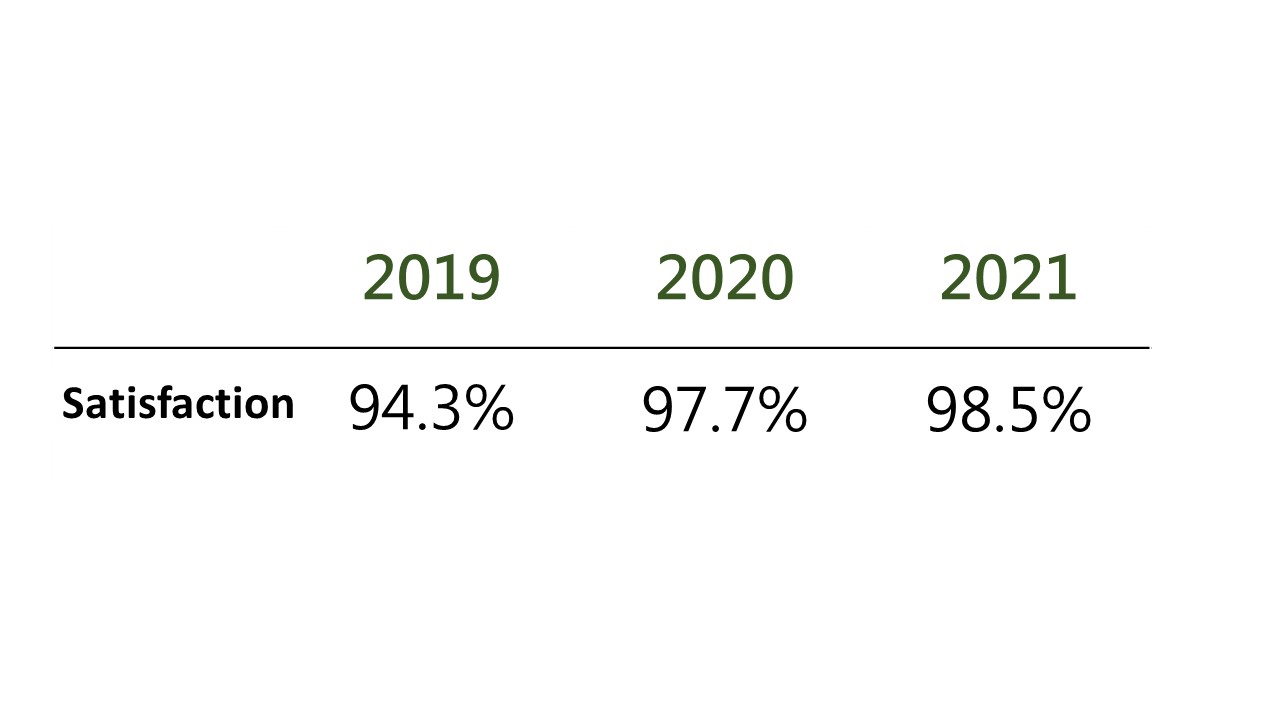

In 2020, to understand the key driving factors of customer satisfaction, we conducted surveys based on more finely divided nodes of service journeys and formulated various optimization plans based on the feedback.

In 2021, the overall customer satisfaction reached 98.5% (better than the 97.7% in 2020); net promoter score (NPS) reached 21.1 (better than the 16.6 last year).

Service Quality Certifications

Considering service inspections by professional

institutions, we continue to improve our services and protect

customer rights:

- The only insurance company to achieve both ISO 10002

& 9001 certifications

- Service center: implementation of QualiCert service

certification.

- Customer service center: the only call center in the

industry obtains three international quality control

certifications. (EN 15838, ISO 10001, and ISO 10002)